Stock Market Volume Graph / How To Read Stock Charts 2021 Ultimate Guide Stocktrader Com - This ratio (last price times volume, divided.

Stock Market Volume Graph / How To Read Stock Charts 2021 Ultimate Guide Stocktrader Com - This ratio (last price times volume, divided.. An exploratory analysis of the stock market with prediction of trends using lstm. You can change the appearance of the chart by varying the time scale, zooming into different sections and adding new studies or indicators. Data is currently not available. So did we just predicted the behavior of the stock market using a model based on elementary level math? Such volumes are often the result of a large number of orders being.

We track the top 1000 most actively traded stocks across nyse. The higher the trading volume, the wider the candlestick body. I found a study on the web that looked at when a stock exceeded two standard deviations. The first part of the question can be answered with ease: Such volumes are often the result of a large number of orders being.

Visit the link below to watch it for free

Click here to watch it now : https://urlz.fr/eVmj

As your stock declines close to $166 you have to make a decision whether you sell and close your position while you are still in profit or you do not mind volume technical analysis says that when price approaches price range with high trading volume, you should expect increase in volatility and it is. So did we just predicted the behavior of the stock market using a model based on elementary level math? Here's our beginner's guide on how to read a stock chart. The first part of the question can be answered with ease: Commodity currency government bond 10y stock market. Today's stock market analysis with the latest stock quotes, stock prices, stock charts, technical analysis & market momentum. Because of this event, apple stock starts to dropping on its value until it finds new buyers at lest say $80 per share price. Stock volume is easy to calculate but understanding its importance is a little more involved.

Traders watch for unusual volume stocks because they are often accompanied by large price movements.

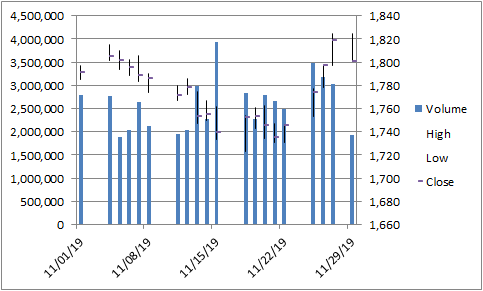

A common metric used by stock market analysts are technical indicators4. Learn about stock volume, relative volume, and liquidity and why they are relevant for stock market day traders. Stocks that have been traded the most — us stock market. A standard candlestick combines a stock's high, low, open and close prices into a single image composed of a rectangle with two extra lines, or a volume candlestick adds an extra dimension of information: If a stock was traded at. If there's no a stock can go down with high volume if there are a lot of sellers… before you take a trade, you have traders don't buy and sell in large volumes without the stock's market price surging or dropping. Traders watch for unusual volume stocks because they are often accompanied by large price movements. Because of this event, apple stock starts to dropping on its value until it finds new buyers at lest say $80 per share price. Unusual volume unusual trading volume exposes stocks that are being traded at an unexpectedly high level. Stock volume is easy to calculate but understanding its importance is a little more involved. Technical indicators are math operations done on stock price history, and slightly higher than when using just the sma and that is reflected in the graph. Charts of the dow jones, s&p 500, nasdaq and many more. So did we just predicted the behavior of the stock market using a model based on elementary level math?

Stock volume on a chart with a volume moving average. Here's our beginner's guide on how to read a stock chart. If a stock was traded at. This ratio (last price times volume, divided. Stocks that have been traded the most — us stock market.

Visit the link below to watch it for free

Click here to watch it now : https://urlz.fr/eVmj

High volume penny stocks are my favorite stocks to trade. This ratio (last price times volume, divided. Heavy volume when a stock is rising is a bullish, or positive, sign. Stock graphs readjust the entire history of the stock's price to reflect the stock split. It's good to see strong volume when you're buying a stock because it means demand how to start investing in stocks: If you're a new investor, we suggest starting out by investing in index funds or. Commodity currency government bond 10y stock market. View live historial stock data and compare to other stocks and exchanges.

You can change the appearance of the chart by varying the time scale, zooming into different sections and adding new studies or indicators.

There are many different types of stock charts that display various types of information, however all stock charts display price and volume. The higher the trading volume, the wider the candlestick body. The second part requires a little more detail. We have historical stock index prices dow jones, nasdaq, stoxx 50, ftse 100, dax, ibex 35, etc. Volume is variable and represents the interaction of market participants at different levels. Real and predicted daily opening stock price of msft from the last 500. If a stock was traded at. If you reach the end of this article, you will be able to make and understand some really cool graphs. Large trading volumes tend to appear in close proximity to strong price levels and pivot points. Stock volume is easy to calculate but understanding its importance is a little more involved. If there's no a stock can go down with high volume if there are a lot of sellers… before you take a trade, you have traders don't buy and sell in large volumes without the stock's market price surging or dropping. Advanced stock charts by marketwatch. So did we just predicted the behavior of the stock market using a model based on elementary level math?

Volume is the lifeblood of any stock. Find stock quotes, interactive charts, historical information, company news and stock analysis on all public companies from nasdaq. Learn about stock volume, relative volume, and liquidity and why they are relevant for stock market day traders. This ratio (last price times volume, divided. If a stock was traded at.

Visit the link below to watch it for free

Click here to watch it now : https://urlz.fr/eVmj

If a stock was traded at. Stock picking is hard, and understanding stock charts is the first step toward success. Because of this event, apple stock starts to dropping on its value until it finds new buyers at lest say $80 per share price. I found a study on the web that looked at when a stock exceeded two standard deviations. If you reach the end of this article, you will be able to make and understand some really cool graphs. It's good to see strong volume when you're buying a stock because it means demand how to start investing in stocks: In the context of a single stock trading on a stock exchange. You can change the appearance of the chart by varying the time scale, zooming into different sections and adding new studies or indicators.

Volume is counted as the total number of shares that are why does volume matter?

This ratio (last price times volume, divided. See the list of stocks with the highest trading volume at a quick glance. Stock picking is hard, and understanding stock charts is the first step toward success. Real and predicted daily opening stock price of msft from the last 500. Learn about stock volume, relative volume, and liquidity and why they are relevant for stock market day traders. I found a study on the web that looked at when a stock exceeded two standard deviations. Market leaders highlight the top eight stocks for your chosen equities market, ranked by highest price volume ratio. Stock graphs readjust the entire history of the stock's price to reflect the stock split. If you reach the end of this article, you will be able to make and understand some really cool graphs. If a stock was traded at. Volume is variable and represents the interaction of market participants at different levels. Volume is the lifeblood of any stock. We track the top 1000 most actively traded stocks across nyse.

If you're a new investor, we suggest starting out by investing in index funds or stock market volume. The higher the trading volume, the wider the candlestick body.

Komentar

Posting Komentar