Gme Stock Uptick Rule / Effective spreads before and after repeal of the uptick ... : This included amc entertainment (nyse:amc), koss corporation (nasdaq:koss), and blackberry (nyse:bb).

Gme Stock Uptick Rule / Effective spreads before and after repeal of the uptick ... : This included amc entertainment (nyse:amc), koss corporation (nasdaq:koss), and blackberry (nyse:bb).. The average gme stock price target is 13.44 with a high estimate of 33.00 and a low estimate of 3.500. The equity market plumbing worked as we expected in the face of a bubble in gamestop stock: I called this earlier, i believe that gme stock is very valuable because games are fun and i hear that hedge funds are desperate for this stock because they think it's going to rise. Wsb must differentiate between squeezing hedge. The rule is triggered when a stock price falls at least 10% in one day.

For example, if company abc is trading at $10 per share, the uptick rule requires investors to short the stock at a price above $10 if the security is down 10% or more from the previous day's close. How to short stocks & uptick rule ☠️ mojo university lesson here is a sample of the swing newsletter i sent to members. Most americans now rely on investing in the market for their retirement and the removal of the uptick rule. Lenders are funds or individuals that own the security. The rule is triggered when a stock price falls at least 10% in one day.

Visit the link below to watch it for free

Click here to watch it now : https://urlz.fr/eVmj

The uptick rule allows investors to short a security only at a price higher than the security's last trade. Uptick rule — the uptick rule is a securities trading rule used to regulate short selling in financial markets. This fee is shown as an annual percentage rate (apr). This has resulted in increased volatility and otherwise ruined the market for the individual small investor. The uptick rule is a trading restriction that states that short selling a stock is only allowed on an uptick. Find the latest gamestop corporation (gme) stock quote, history, news and other vital information to help you with your stock trading and investing. This included amc entertainment (nyse:amc), koss corporation (nasdaq:koss), and blackberry (nyse:bb). Violating spam rules may result in a permanent ban.

The rule is triggered when a stock price falls at least 10% in one day.

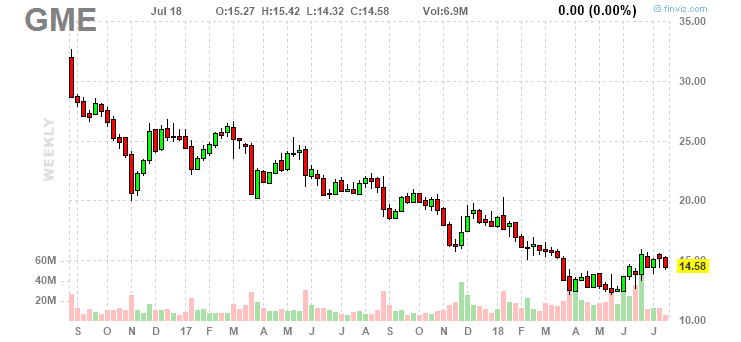

Gme stock at the center of the battle. This included amc entertainment (nyse:amc), koss corporation (nasdaq:koss), and blackberry (nyse:bb). The equity market plumbing worked as we expected in the face of a bubble in gamestop stock: Soaring, while hedge funds that bet against the chosen. Violating spam rules may result in a permanent ban. The media is honing in on several stocks that robinhood restricted trading on. For example, if company abc is trading at $10 per share, the uptick rule requires investors to short the stock at a price above $10 if the security is down 10% or more from the previous day's close. View live gamestop corporation chart to track its stock's price action. Wsb must differentiate between squeezing hedge. Gme | complete gamestop corp. A bit of history about the uptick rule. For the rule to be satisfied, the short must be either at a price above the last traded price of the security. Most americans now rely on investing in the market for their retirement and the removal of the uptick rule.

For example, if company abc is trading at $10 per share, the uptick rule requires investors to short the stock at a price above $10 if the security is down 10% or more from the previous day's close. I called this earlier, i believe that gme stock is very valuable because games are fun and i hear that hedge funds are desperate for this stock because they think it's going to rise. Lenders are funds or individuals that own the security. You can find more details by going to one of the sections under this page such as historical data. The uptick rule is a financial regulation that requires short sales to be conducted at a higher price than the previous trade.

Visit the link below to watch it for free

Click here to watch it now : https://urlz.fr/eVmj

The equity market plumbing worked as we expected in the face of a bubble in gamestop stock: Gme stock at the center of the battle. Soaring, while hedge funds that bet against the chosen. Stock screener for investors and traders, financial visualizations. Violating spam rules may result in a permanent ban. For the rule to be satisfied, the short must be either at a price above the last traded price of the security. The current restriction approximates the resistance provided by the uptick rule, prohibiting short sales for two days after a stock falls below 10 percent of its value the previous trading day. Money flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an uptick in price and the value of trades made on a.

Uptick rule — the uptick rule is a securities trading rule used to regulate short selling in financial markets.

Stocks percent change top 100 stocks stocks highs/lows stocks volume leaders unusual options activity options volume leaders remove ads. The current restriction approximates the resistance provided by the uptick rule, prohibiting short sales for two days after a stock falls below 10 percent of its value the previous trading day. Cl a stock news by marketwatch. The average gme stock price target is 13.44 with a high estimate of 33.00 and a low estimate of 3.500. For the rule to be satisfied, the short must be either at a price above the last traded price of the security. Soaring, while hedge funds that bet against the chosen. The uptick rule allows investors to short a security only at a price higher than the security's last trade. View live gamestop corporation chart to track its stock's price action. The equity market plumbing worked as we expected in the face of a bubble in gamestop stock: The uptick rule is a financial regulation that requires short sales to be conducted at a higher price than the previous trade. Cl a (gme) stock price, news, historical charts, analyst ratings and financial information from wsj. Violating spam rules may result in a permanent ban. I called this earlier, i believe that gme stock is very valuable because games are fun and i hear that hedge funds are desperate for this stock because they think it's going to rise.

For the rule to be satisfied, the short must be either at a price above the last traded price of the security. For example, if company abc is trading at $10 per share, the uptick rule requires investors to short the stock at a price above $10 if the security is down 10% or more from the previous day's close. Cl a (gme) stock price, news, historical charts, analyst ratings and financial information from wsj. On the other hand, there is a study suggesting that the alternative uptick rule was effective in that it reduced what's called asymmetric volatility. Find the latest gamestop corporation (gme) stock quote, history, news and other vital information to help you with your stock trading and investing.

Visit the link below to watch it for free

Click here to watch it now : https://urlz.fr/eVmj

It looks like the uptick rule might return from the dead. Money flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an uptick in price and the value of trades made on a. The equity market plumbing worked as we expected in the face of a bubble in gamestop stock: For example, if company abc is trading at $10 per share, the uptick rule requires investors to short the stock at a price above $10 if the security is down 10% or more from the previous day's close. The uptick rule allows investors to short a security only at a price higher than the security's last trade. The current restriction approximates the resistance provided by the uptick rule, prohibiting short sales for two days after a stock falls below 10 percent of its value the previous trading day. You can gain the experience necessary to know the top time to short. Lenders are funds or individuals that own the security.

Uptick rule — the uptick rule is a securities trading rule used to regulate short selling in financial markets.

View the latest gamestop corp. The current restriction approximates the resistance provided by the uptick rule, prohibiting short sales for two days after a stock falls below 10 percent of its value the previous trading day. At that point, short selling is permitted if the price is above the current best bid. Stock screener for investors and traders, financial visualizations. Money flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an uptick in price and the value of trades made on a. It looks like the uptick rule might return from the dead. This table shows the interest rate that must be paid by a short seller of us:gme to the lender of that security. Cl a (gme) stock price, news, historical charts, analyst ratings and financial information from wsj. This fee is shown as an annual percentage rate (apr). As soon as this rule was executed, the stock started going back up to $3.7 (as of now) from $2.80 in the first 5. For the rule to be satisfied, the short must be either at a price above the last traded price of the security. The uptick rule is a financial regulation that requires short sales to be conducted at a higher price than the previous trade. The uptick rule allows investors to short a security only at a price higher than the security's last trade.

A bit of history about the uptick rule gme stock up. A bit of history about the uptick rule.

Komentar

Posting Komentar